method-matching

When to use which component of the S360

Different methods give different perspectives on stakeholder relations. Different circumstances make some methods more practical than others. That’s why the S360 has an array of methodological components. Depending on the needs and the situation, it may be best to use them all, or just one or two.

Net-Work-Shop

A census of stakeholders and their networks normally takes about two or three months. For more urgent needs where a rough approximation will do, a stakeholder network workshop offers a shortcut.

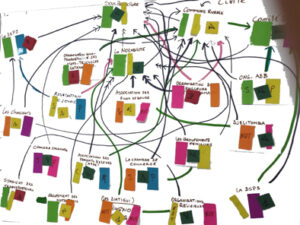

A Net-Work-Shop collates the network information that employees already have. Staff who deal with stakeholders or their issues get together to put their knowledge on a single network map laid out on a tabletop. Different markers show which stakeholders support the organization’s activity, which have more power, and which care about different issues. When time or distance does not permit all staff to gather around a table, the S360 offers an online network creation tool that can be used on any meeting platform.

The result is a common understanding of the network’s dynamics based on everyone’s shared knowledge. It raises commitment for stakeholder initiatives. Blind spots become visible. It becomes clear where more information is most urgently needed. Top messages and focal themes become obvious. The final phase of the workshop translates the strategic insights into commitments to action, with specific dates, tasks, and resources.

Census of opinion leaders

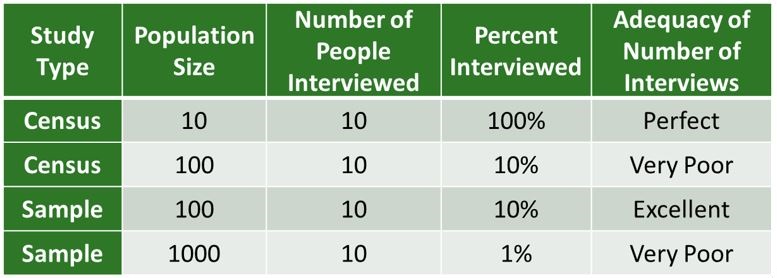

Like a random sample survey, a census involves personal interviews. However, the selection process is quite different. The numbers of prominent opinion leaders in most policy fields is limited. For a policy like permitting the construction of a highway between two cities, the opinion leaders typically consist of several dozen organizations and experts (e.g., some village councils, farmers’ groups, environmental groups, and transportation companies). With anywhere from 50 to 100 interviews, all the opinions of all the opinion leaders can be solicited. This would constitute a census of the whole population of opinion leaders.

A survey takes a sample of a few hundred interviews and tries to generalize to thousands or millions in a population. A census attempts to interview the entire population, or at least 90% of it. With a census, the sample size is irrelevant because there is no sampling from the population. It is the population.

The table below shows how 20 interviews can be good or bad depending on the size of the population and the choice of a sample survey versus a census.

Random sample public opinion polling

Some important groups have no leaders or spokespersons. In those cases, a public opinion survey is needed. For example, “citizens” are a stakeholder group for a city council and “customers” are a stakeholder group for a consumer products company. A random sample of public opinion can also be useful when the social license of an entire industry is being challenged or when a project has been seized by urban media and activists as emblematic of an international policy narrative (for example, the energy transition).

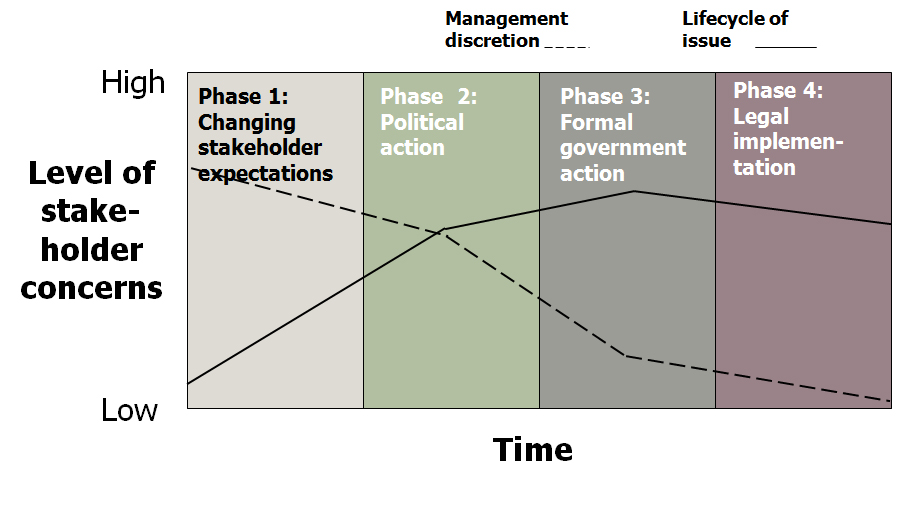

The choice of a census versus a sample is not dichotomous (either/or). The census should be the basic method and under some circumstances a survey should be added. But when?

When a focal project has not become controversial, public opinion generally follows the opinions of stakeholder group leaders. Consequently, a public opinion survey adds little value. However, in a public controversy where politicians or decision-makers need general public approval, the addition of a public opinion survey is recommended.

The graph below shows the typical lifecycle of an issue that becomes controversial. In Phase 1, a census of opinion leaders is the best. If the issue explodes into Phase 2, a random sample survey should be added. At Phase 3, the decision makers will often follow public opinion. By Phase 4, the policy change is in the process of becoming business as usual.

A census is generally the same in terms of price and speed as a random sample survey. A census can take less time to complete the interviews but can take more time at the analysis stage, owing to its greater depth. The greater depth comes from questions on stakeholders networks. These reveal who is more influential in the community/network. A sample survey cannot obtain this information.

Media monitoring with AI topic detection

Automated media/internet monitoring, using artificial intelligence, requires so much data that it works best at a national or international level. It is more applicable to broader issues, such as newsworthy controversies or perceptions of whole industries that get mentioned often on the internet.

Automated internet monitoring costs much less than a random sample public opinion survey, especially if continuous monitoring is desired. The method is actually a pair of specific capacities:

One is sentiment analysis, the detection of positive or negative feelings about the topic mentioned.

The other is automated content analysis (“topic identification”), the identification of the theme or narrative expressed in a text.

Sentiment analysis works better when the software is trained on texts that are as contextually similar as possible to texts from which the sentiment is to be extracted. Automated content analysis, by contrast, can be applied to nearly any body of texts.