Not a survey

S360 is a census, not a survey

Focus on group level

The Stakeholder 360® focuses on the group level. People have more socio-political impact when they work in groups. The groups do not necessarily have to be formal organizations. For example, in a study in Papua New Guinea, we treated clans as stakeholder groups and interviewed the elders as the representatives of the clans.

Some important groups have no leaders or spokespersons. In those cases, a public opinion survey is needed. For example, “citizens” are a stakeholder group for a city council and “customers” are a stakeholder group for a consumer products company. When a focal project has not become controversial, public opinion generally follows the opinions of stakeholder group leaders. Consequently, a public opinion survey adds little value. However, in a public controversy where politicians or decision-makers need public approval, a public opinion survey is recommended.

At times, a single individual can be treated as a stakeholder, with the implicit assumption that they have a high level of influence potential in a socio-political sense. For example, sometimes experts, politicians, or celebrities fall into this category.

Census completeness

People familiar with public opinion research sometimes question the small number of interviews needed when only stakeholder group leaders are studied. They forget the difference between a sample and a population census. Unless the focal activity or company has become an election issue, the Stakeholder 360® does not include a random sample survey of stakeholders.

Instead, it attempts a census of their leaders and spokespersons. The “sample size” is irrelevant because there is no sample. Instead, there is a census. In terms of the number of interviews conducted, what is important is that the census includes all of the members of the stakeholder network.¹

1. The methodological question is not whether enough groups were interviewed to estimate population means. Rather, it is how close to (100%) of the concerned groups were interviewed.

Different stakeholders require different approaches

Samples and censuses each have their strengths.² It is often a good idea to use the Stakeholder 360® in conjunction with a random sample survey of some unorganized population like customers or citizens. Stakeholder group leaders tend to be mass opinion leaders. Sample surveys can tell you how broadly legitimate the views of different groups are perceived to be.

Elected government stakeholders are especially interested in these kind of findings when the focal activity has the potential to be an election issue. Outside of that situation, the S360 focuses on leaders of organized group in order to gain insights into where public opinion is headed next. In that way it also taps into more highly articulated versions of each opinion tendency and trend.

2. See Boutilier (2000) for a conference paper on the advantages of multiple methods in research with customer stakeholders.

Content of the interview

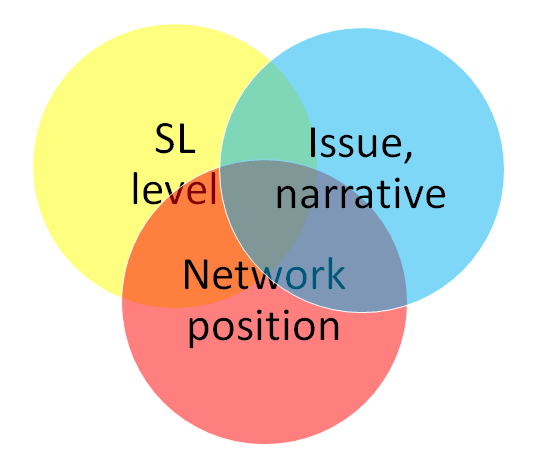

The S360 interview with stakeholders elicits three types of data:

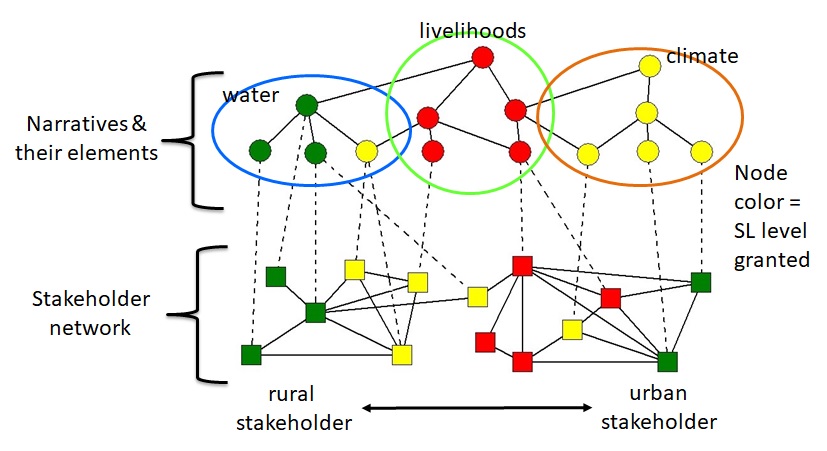

Concerns and priorties in general and, regarding the focal organization’s activity, the perceived pros and cons. These questions elicit the narrative that the stakeholder uses to understand the activity.

Level of social licence granted to the focal organization’s activity

A list of working relationships with other stakeholders, including ratings of the level of satisfaction and mutual agreement in the relationship.

The graph below shows and example of the first type of data on the top half and the third type on the bottom half. The social licence levels are indicated by the colors of the nodes (green = high SL).